The current ratio is current assets (assets that can be converted to cash within a year) divided by current liabilities (debts that need to be repaid within a year). Calculating key indicators related to solvency, profitability, and management helps you better assess your business’s health. A smaller value or lower value of the ratio is recommended as it will make the company more efficient in generating revenue.

Key Takeaways:

For example, Costco has maintained an industry-leading operating Ratio among retail chains, averaging around 9-10% over the last decade compared to 25% for Walmart. This shows Costco’s warehouse model leads to very low operating costs as % of sales. Beyond operating Ratio, investors should also look at key performance indicators like revenue growth, market share changes, return on invested capital, cash flows, and balance sheet strength. The objective is to find well-run businesses with solid competitive advantages and growth prospects.

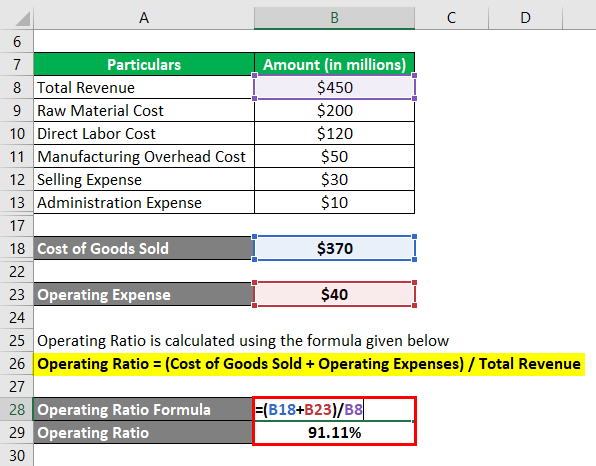

How to Calculate the Operating Ratio

Companies sometimes can cut costs in the short term thus inflating their earnings temporarily. Investors must monitor costs to see if they’re increasing or decreasing over time while also comparing those results to the performance of revenue and profit. The operating expense ratio (OER) is used in the real estate industry and is a measurement of what it costs to operate a property compared to the income that the property generates.

Operating Profit Ratio

Additionally, fostering a culture of continuous improvement can encourage employees to identify and implement cost-saving measures. Learn about operating ratio, its calculation, key components, industry benchmarks, and strategies for improvement to enhance business efficiency. The total operating expenses consist of two components, the cost of goods sold and operating expenses. Return on equity ratio is a profitability ratio which reflects how profitable companies are in relation to their shareholders’ investment. It shows how much money returns to the owners for each dollar invested by them, which enables investors to determine whether it would be worthwhile investing more funding into the company.

- Operations-intensive businesses such as transportation, which may have to deal with fluctuating fuel prices, drivers’ perks and retention, and vehicle maintenance, usually have lower profit margins.

- Operating expenses include administrative expenses, selling and distribution expenses, cost of goods sold, salary, rent, other labor costs, depreciation, etc.

- Trends in the operating Ratio over time provide insight into management’s ability to manage expenses.

- The cash conversion cycle shows how quickly a firm converts its investment in inventory into cash.

Outsourcing non-core activities is another strategy that can yield substantial benefits. By partnering with specialized service providers for tasks such as IT support, payroll processing, or even certain aspects of logistics, companies can focus their resources on core business activities. This not only reduces overhead costs but also allows for greater cash flow worksheet scalability and flexibility. Solvency indicates your company’s ability to meet its obligations on an ongoing basis, not just in the short term. The debt-to-equity (D/E) ratio is the best way to calculate your business’s solvency. A high turnover ratio, and thus a low DOH ratio, may mean that the firm isn’t keeping enough inventory on hand.

Compare the company’s latest operating Ratio to industry benchmarks and peers to contextualize operational efficiency. This gap could pressure margins over time, making the company less profitable than its peers. On the flip side, an operating ratio below industry benchmarks indicates a competitive advantage in managing operating costs and translating revenues into profits. It is calculated by dividing a company’s operating expenses by its net sales or revenue. The operating Ratio shows the efficiency of a company’s management by comparing production costs to net sales.

Analysts often monitor operational ratios as a helpful indicator of productivity, profitability drivers, and management execution when assessing a company’s financial performance. Multi-period trends in operating ratios help determine ideal investment entry and exit points. For example, an elevated ratio sometimes signals a stock is overvalued and set to decline, prompting an investor to delay purchase. The utility sector, known for its heavy infrastructure and regulatory costs, usually has higher operating ratios, reflecting the substantial investment in maintaining and expanding service capacity.

Diversifying revenue streams can provide a buffer against market fluctuations and contribute to a more favorable operating ratio. The simplicity of the operating ratio makes it an accessible tool for businesses of all sizes. It allows for quick assessments and comparisons, both internally over different periods and externally against industry peers. This ease of use is one reason why the operating ratio is a favored metric among financial analysts and business managers alike. Operating ratio is used to determine the efficiency of the management with which it is possible to generate a certain level of sales or revenue.