Katie Miller are a customer financial features pro. She struggled to obtain nearly two decades just like the a manager, top multiple-billion dollar financial, credit card, and you may savings portfolios which have functions internationally and you may an alternate work with the consumer. Their own mortgage solutions was honed article-2008 drama due to the fact she adopted the main alter as a consequence of Dodd-Honest needed rules.

Installing a unique pond will be an investment you to will bring your own relatives numerous years of athletics and you will fun times, nevertheless would be pricey. Before you could believe a swimming pool, it is advisable to determine if this tends to make financial experience to suit your issues, and if it’s well worth investigating pool resource to make your yard dream a real possibility.

Secret Takeaways

- There are a number of share capital possibilities, also personal loans and household guarantee loans.

- Whenever comparing pond financing, compare rates and financing terms and conditions for the best equipment to meet your needs.

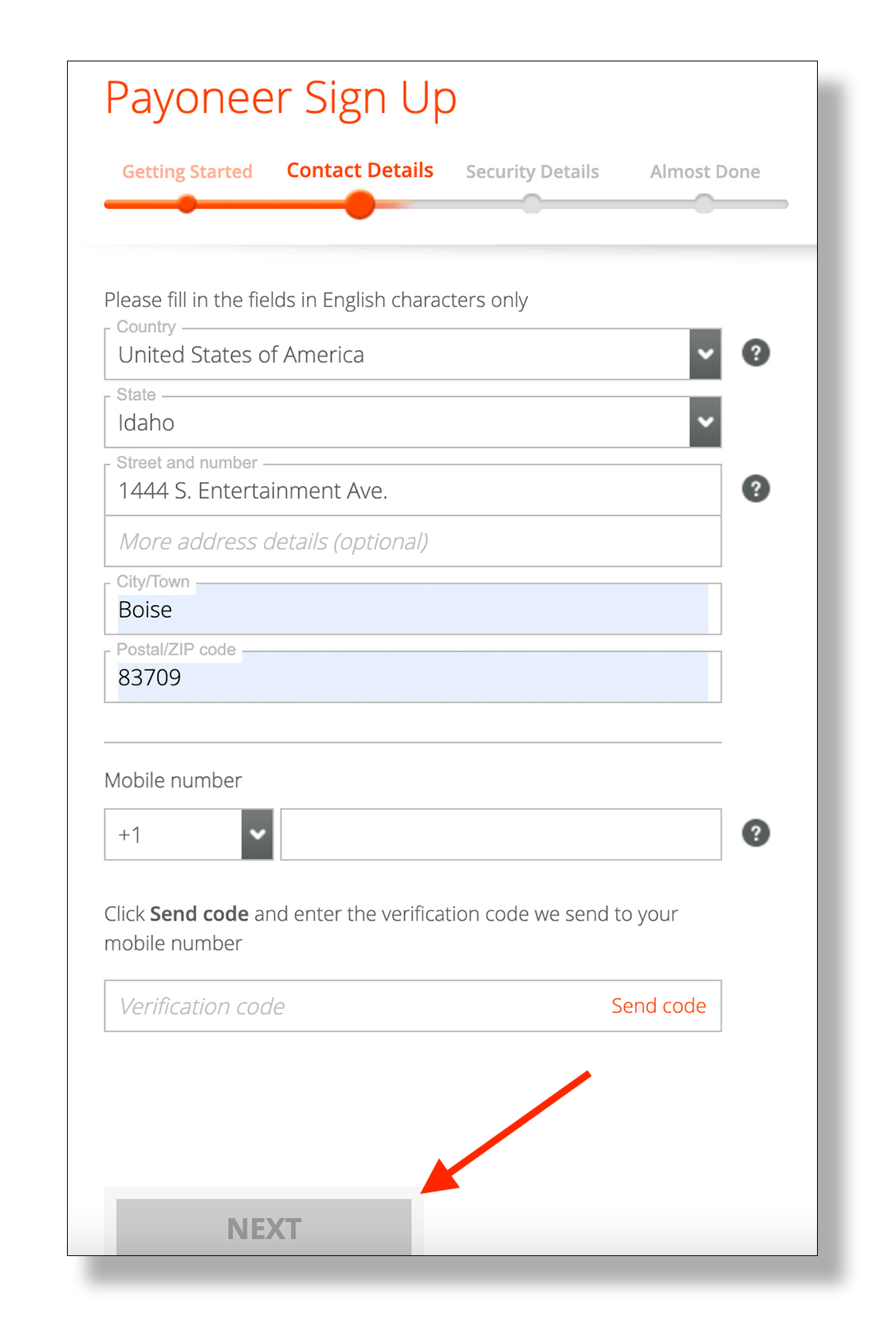

- To secure swimming pool investment, search loan providers, assess the credit, and you may assemble this new records you’ll need for the application.

- That have a share can get help the property value your property by the in the 7%.

Swimming pool Will set you back

Centered on HomeAdvisor, the typical cost of strengthening a pool on your lawn range off $20,000 to $100,000, that have a national average out-of $62,500. One last price tag is determined by some affairs, including the measurements of the brand new pond, the sort of information made use of, plus place.

Above-ground pools is actually far less expensive, that have an average $700$5,000 cost. While you are breaking surface, expect it in order to rates a critical four-contour count. Material-smart, real is among the most pricey, performing around $fifty,000, but it continues brand new longest. Fiberglass is actually less expensive and contains down repairs can cost you, if you are synthetic is generally the cheapest but may want significantly more upkeep.

Additionally, that have a pool boasts lingering maintenance costs, which also believe the type of pool. You will want to expect you’ll funds up to $80 in order to $150 a month to have pond repair (opening and you will closing costs in addition to chemical compounds). Along with, the electric statement will likely rise of the up to $fifty, or higher by using a share furnace.

That have a pool can increase the value of property by 5% to eight%. It is highest if you’re into the a hotter state such as for instance Florida otherwise Tx.

Eligibility Conditions

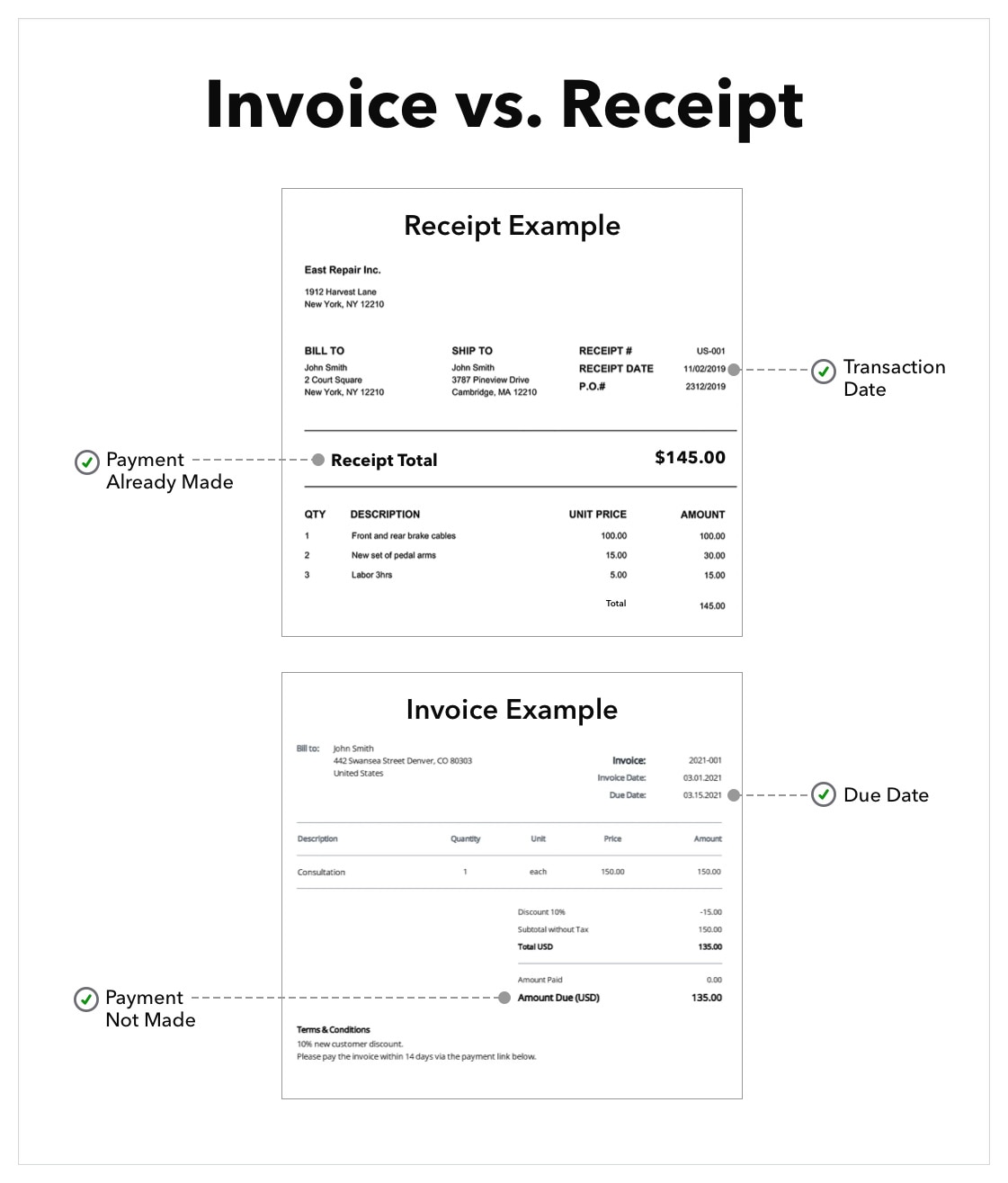

Of course, if you’re considering a credit product, you should first determine your creditworthiness by thinking about the credit score. Lenders generally speaking feedback your credit history and would like to make certain that you have got constant money so you’re able to agree your getting a financing.

The greater your credit rating, the more likely you could potentially be eligible for probably the most advantageous desire rates given. When you are which have struggles with borrowing from the bank if any verifiable income, the loan choices can be minimal or maybe more costly.

Rates

Whenever funding a new pool, you need to get prices out of several lenders. Large notice often perception their invoice therefore the matter you wind up spending along side lifetime of the borrowed funds. And their borrowing from the bank and you can finances, other things can impact interest levels include general economic conditions, the total amount your borrow plus the label loans Grand View Estates of loan, plus area.

Financing Terms and conditions and Repayment Possibilities

Along the mortgage (the borrowed funds label) and exactly how your pay the borrowed funds are important knowing while the they will certainly feeling your financial allowance. Stretched mortgage conditions can be reduce your monthly bill, but you will shell out more over the life of financing. In terms of repayment solutions, inquire on how flexible lenders are about how precisely your repay the loan. For-instance, will there be a beneficial prepayment penalty? Are there discounts for setting up autopay?